Volatility Swap vs Variance Swap Replication - Truncation

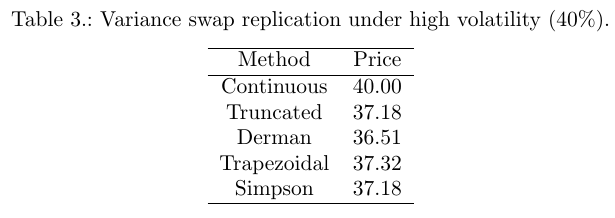

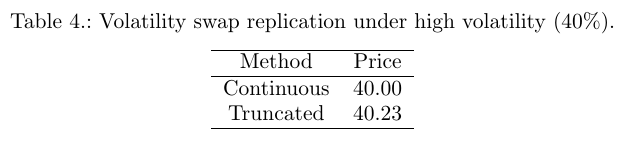

I have looked at jump effects on volatility vs. variance swaps. There is a similar behavior on tail events, that is, on truncating the replication. One main problem with discrete replication of variance swaps is the implicit domain truncation, mainly because the variance swap equivalent log payoff is far from being linear in the wings. The equivalent payoff with Carr-Lee for a volatility swap is much more linear in the wings (not so far of a straddle). So we could expect the replication to be less sensitive to the wings truncation. I have done a simple test on flat 40% volatility:

As expected, the vol swap is much less sensitive, and interestingly, very much like for the jumps, it moves in the opposite direction: the truncated price is higher than the non truncated price.