Quadratic Spline with Knots at Mid-Points

Two months ago, I looked at arbitrage free interpolation using piecewise-constant density. This is equivalent to a piecewise quadratic polynomial in call prices where each piece is centered around each call strike.

I wondered at the time what a quadratic spline would look like on this problem, as it should be very close in theory, except that we can ensure that it is C1, a condition for a good looking implied volatility.

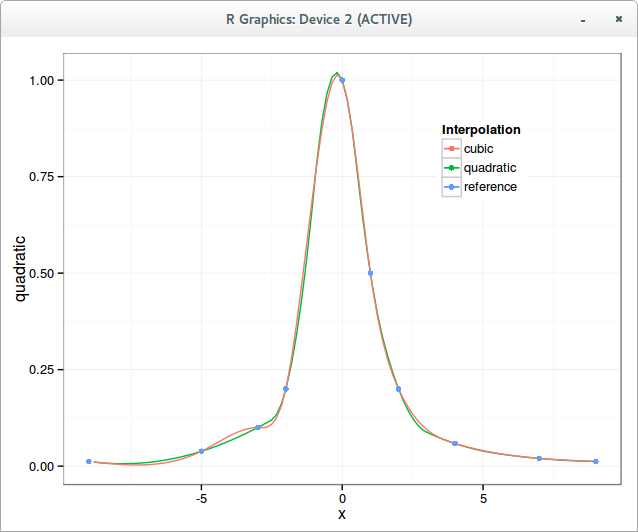

For a while, I did not find any references around splines where knots are in between two interpolation points and derived my own formula. And then I lost the paper, but out of curiosity, I looked at the excellent De Boor book “A Practical Guide to Splines” and found that there was actually a chapter around this: quadratic splines with knots at mid-points. Interestingly, it turns out that a quadratic spline on standard knots is not always well defined, which is why, if one does quadratic splines, the knots need to be moved.The papers from this era are quite rudimentary in their presentation (the book is much better). I found the paper from Demko 1977 “Interpolation by Quadratic Splines” quite usable for coding. I adjusted the boundaries to make the first and last quadratic fit the first two/last two strikes (adding a first strike at 0 and a large last strike if necessary) and spend countless time worrying about indices. The result on a simple classic example is interesting.

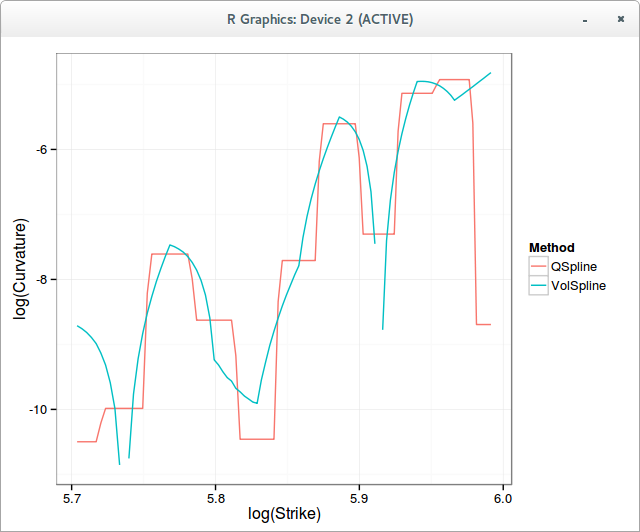

On the non monotonic discrete density data of my earlier blog entry, this gives:

QSpline is the quadratic spline

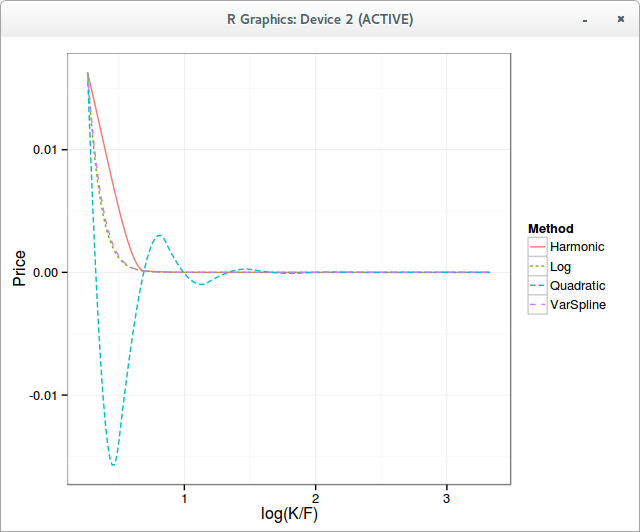

Unfortunately, interpolating small prices with such a spline results in a highly oscillating interpolation: this is the Gibbs phenomenon for splines. We need to loose strict C1 continuity for practical applications, and use a first derivative approximation instead, very much like the Harmonic cubic spline.

On Jaeckel data, the quadratic spline on prices is highly oscillating