Princeton Fintech and Quant conference of December 2022

I recently presented my latest published paper On the Bachelier implied volatility at extreme strikes at the Princeton Fintech and Quant conference. The presenters were of quite various backgrounds. The first presentations were much more business oriented with lots of AI keywords, but relatively little technical content while the last presentation was about parallel programming. Many were a pitch to recruit to employees.

The diversity was interesting: it was refreshing to hear about quantitative finance from vastly different perspectives. The presentation from Morgan Stanley about their scala annotation framework to ease up parallel programming was enlightening. The main issue they were trying to solve is the necessity for all the boilerplate code to handle concurrency, caching, robustness, which obfuscates significantly the business logic in the code. This is an old problem. Decades ago, rule engines were the trend for similar reasons. Using the example of pricing bonds, the presenters put very well forward the issues in evidence, issues that I found very relevant.

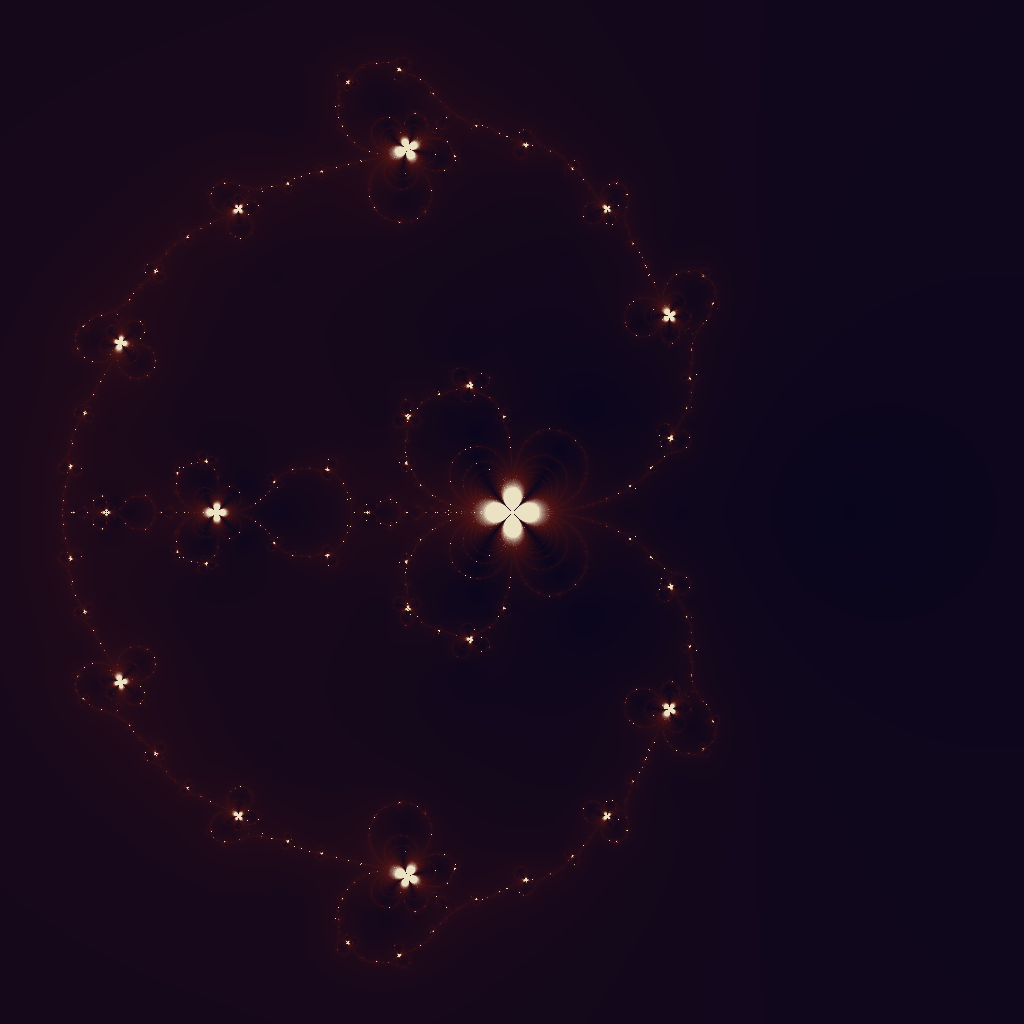

While writing my own presentation, I realized I had not tried to plot the Bachelier implied volatility fractals. The one corresponding to the Householder method is pretty, and not too far off from the Black-Scholes case, possibly because the first, second and third derivatives towards the vol are similar between the two models.

Iterations of the Householder method on the problem of solving the Bachelier implied volatility for a given strike and maturity. Each point corresponds to an initial guess in the complex plane.

Of course, this is purely for the fun as this has no practical importance, since we can invert the Bachelier price with near machine accuracy through a fast analytic formula.