The Finite Difference Theta Scheme Optimal Theta

The theta finite difference scheme is a common generalization of Crank-Nicolson. In finance, the book from Wilmott, a paper from A. Sepp, one from Andersen-Ratcliffe present it. Most of the time, it’s just a convenient way to handle implicit \(\theta=1\), explicit \(\theta=0\) and Crank-Nicolson \(\theta=0.5\) with the same algorithm.

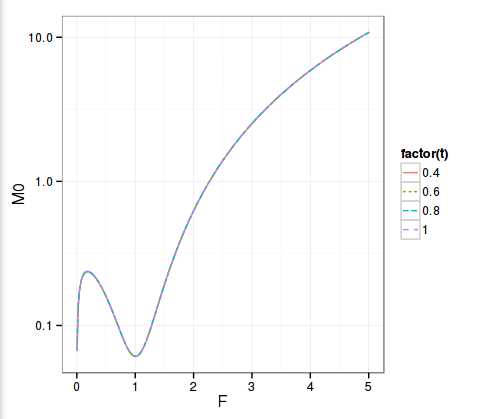

Wilmott makes an interesting remark: one can choose a theta that will cancel out higher order terms in the local truncation error and therefore should lead to increased accuracy. $$\theta = \frac{1}{2}- \frac{(\Delta x)^2}{12 b \Delta t} $$ where \(b\) is the diffusion coefficient. This leads to \(\theta < \frac{1}{2}\), which means the scheme is not unconditionally stable anymore but needs to obey (see Morton & Mayers p 30): $$b \frac{\Delta t}{(\Delta x)^2} \leq \frac{5}{6}$$ and to ensure that \(\theta \geq 0 \): $$b \frac{\Delta t}{(\Delta x)^2} \geq \frac{1}{6}$$

Crank-Nicolson has a similar requirement to ensure the absence of oscillations given non smooth initial value, but because it is unconditionality stable, the condition is actually much weaker if \(b\) depends on \(x\). Crank-Nicolson will be oscillation free if \(b(x_{j0}) \frac{\Delta t}{(\Delta x)^2} < 1\) where \(j0\) is the index of the discontinuity, while the theta scheme needs to be stable, that is \(\max(b) \frac{\Delta t}{(\Delta x)^2} \leq \frac{5}{6}\)

This is a much stricter condition if \(b\) varies a lot, as it is the case for the arbitrage free SABR PDE where \(\max(b) > 200 b_{j0}\)