SVI, SABR, or parabola on AAPL?

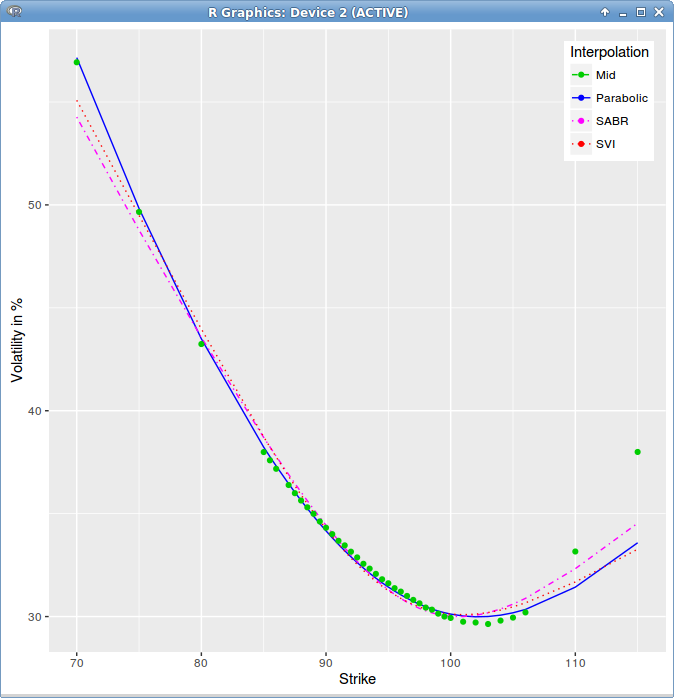

In a previous post, I took a look at least squares spline and parabola fits on AAPL 1m options market volatilities. I would have imagined SVI to fit even better since it has 5 parameters, and SABR to do reasonably well.

It turns out that the simple parabola has the lowest RMSE, and SVI is not really better than SABR on that example.

SVI, SABR, least squares parabola fitted to AAPL 1m options

Note that this is just one single example, unlikely to be representative of anything, but I thought this was interesting that in practice, a simple parabola can compare favorably to more complex models.