Remarkable Coincidences, Bad Book?

I stumbled upon a new short book Financial Models in Production from O. Kettani and A. Reghai. A page attracted my attention

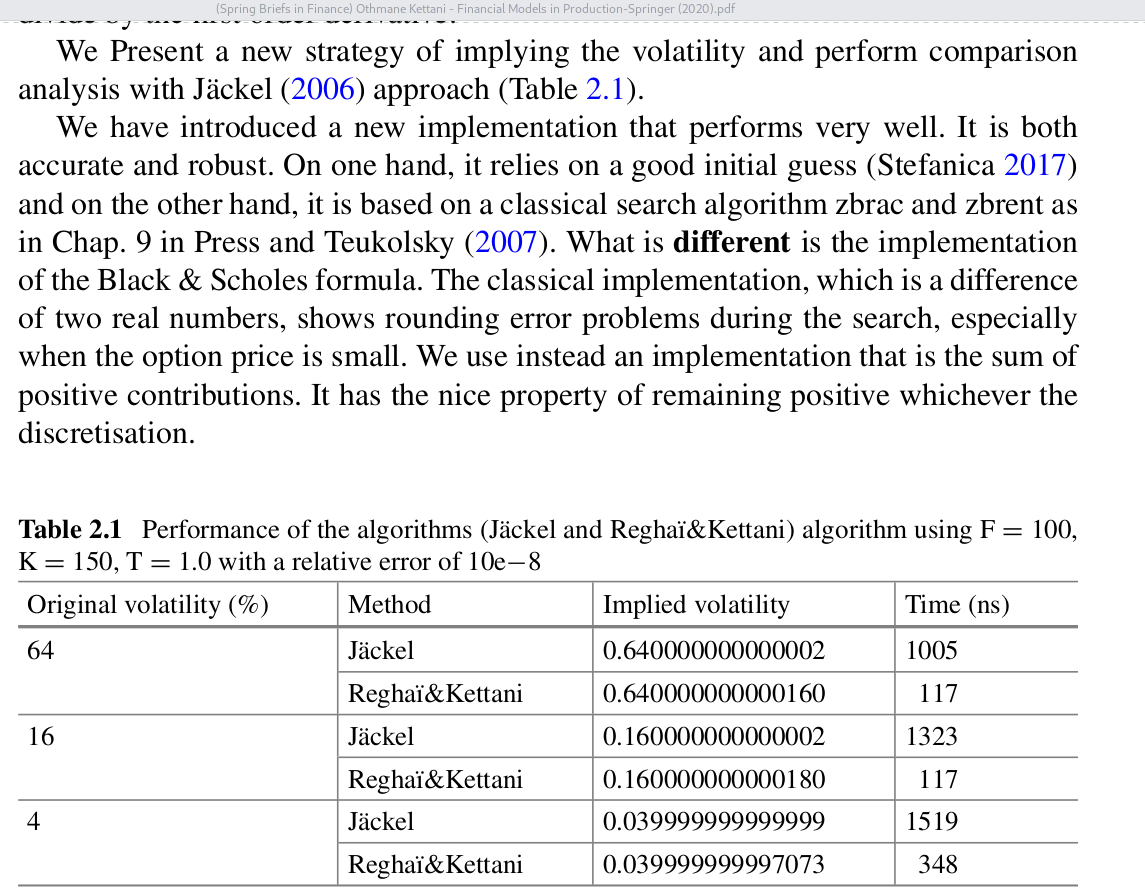

A page from Kettani and Reghai's book.

This is the same example as I used on my blog, where I also present the Li’s SOR method combined with the good initial guess from Stefanica. The idea has also been expanded on in Jherek Healy’s book. What is shocking is that, beside reusing my example, they reuse my timing for Jäckel and my implementation is in Google Go, with a timing done on some older laptop. The numbers given are thus highly inconsistent. Of course, none of this is mentioned anywhere, and the book does not reference my blog.

I also find the description of how they improve the implied volatility algorithm (detailed on the next page) to not make much sense. After this kind of stuff, you can’t really trust anything that is in the book…

Worst perhaps, is that the authors advertise their “novel” technique in otherwise decent talks and conferences, such as the one from mathfinance. Here is a quote

Enforced Numerical Monotonicity (ENM) beats Jäckel’s implied volatility calculations – an implied vol calculator that never breaks and automatically fits vanilla option prices.

It is really unfortunate that the world we live in encourages such boasting. Papers always need to present some novel ideas to be published, but there is too often no check on whether the idea actually works, or is worth it. The temptation to make exagerated claims is very high for authors. In the end, it becomes not so easy to sort out the good from the bad.