A New Asian Basket Spread Option Approximation

Around 10 years ago, while reading the excellent paper of Etore and Gobet on stochastic Taylor expansions for the pricing of vanilla options with discrete (cash) dividends, I had the idea of a small improvement, by using a more precise proxy for the Taylor expansion.

More recently, I applied the idea to approximate arithmetic Asian options prices by using the geometric Asian option price as a proxy (with some adjustments). This worked surprisingly well, and is competitive with the best implementations of Curran approach to Asian options pricing. I quickly noticed that I could apply the same idea to approximate Basket option prices, and from it obtain another approximation for vanilla options with cash dividends through the mapping described by J. Healy. Interestingly the resulting approximation is the most accurate amongst all other approximations for cash dividends.

During my Easter holidays, I took the time to further extend the idea to cover general spread options such as Asian Basket spread options. I was slightly surprised at the resulting accuracy: the approximation is by far more accurate than any other published approximation on this problem. Somewhat interestingly, I noticed that the first order expansion (which is not much more accurate than the proxy itself) seemed to correspond to a previously published approximation from Tommaso Pellegrino, an extension of Bjerksund-Stensland approximation for spread options, although my derivation is very different and allows for higher-order formulae.

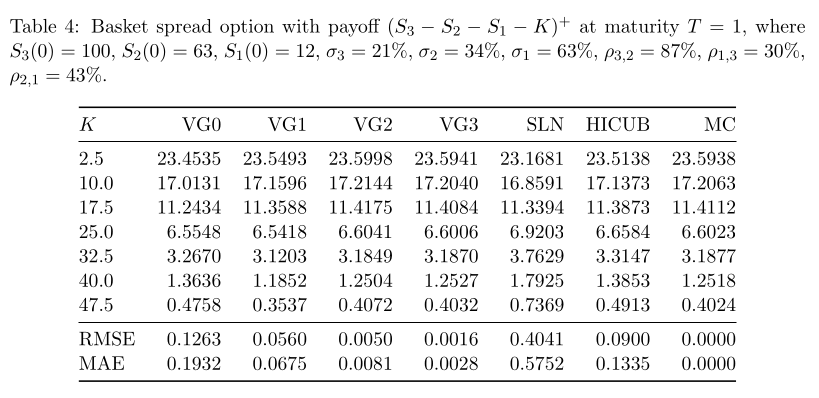

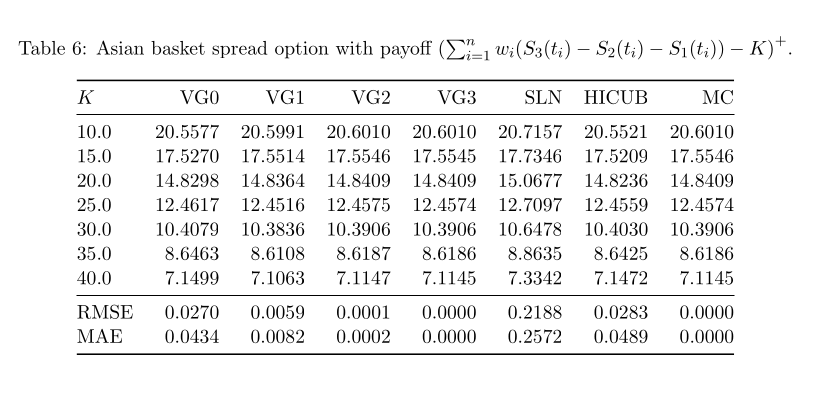

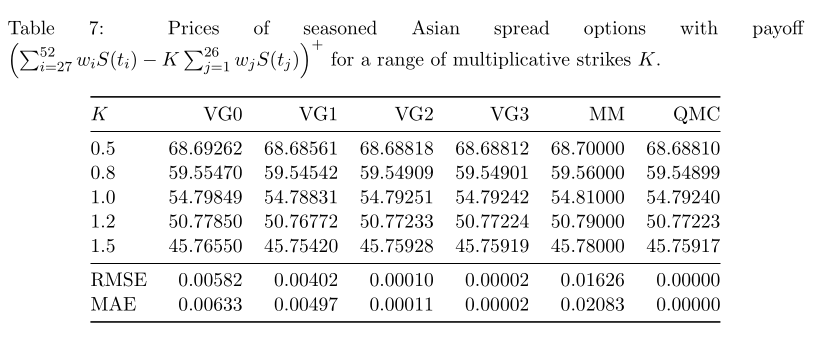

Below is an excerpt of some of the results

Original example from Deelstra et al. for an Basket spread option.

Original example from Deelstra et al. for an Asian Basket spread option. The Taylor approximation perform even better due to the Asianing.

Original example from Martin Krekel for an Asian spread option. It was actually challenging to compute accurate Quasi Monte-Carlo prices.

The MM of Martin Krekel consists in a one-dimensional integration of two lognormal moment-mached distributions. It seems that the one-dimensional integration (which is exact for simple spread options) does not really improve the accuracy for the more general asian spread option case: the loss of accuracy due to moment matching dominates the error.

The preprint is available on Arxiv.