New Basket Expansions and Cash Dividends

In the previous post, I presented a new stochastic expansion for the prices of Asian options. The stochastic expansion is generalized to basket options in the paper, and can thus be applied on the problem of pricing vanilla options with cash dividends.

I have updated the paper with comparisons to more direct stochastic expansions for pricing vanilla options with cash dividends, such as the one of Etoré and Gobet, and my own refinement on it.

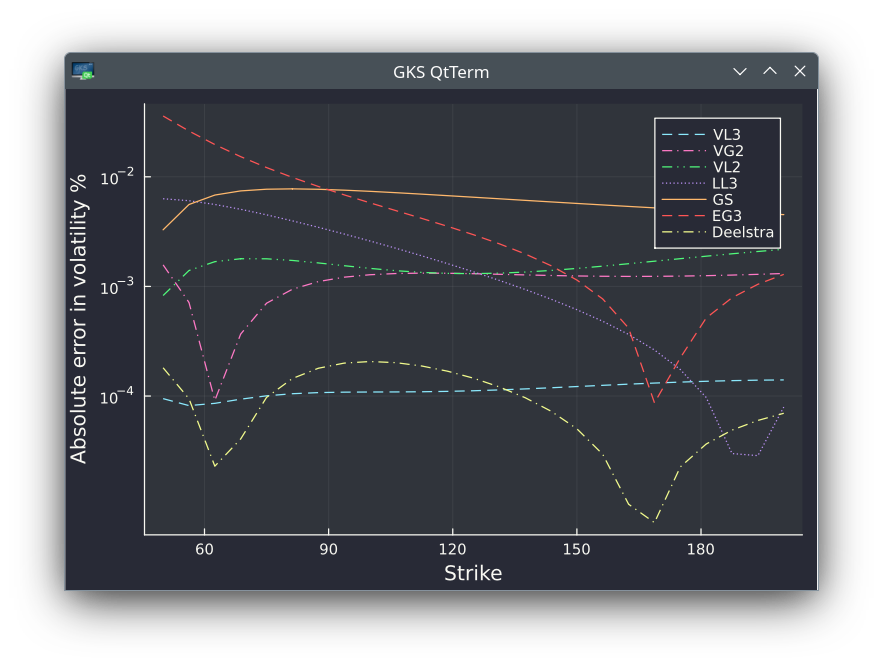

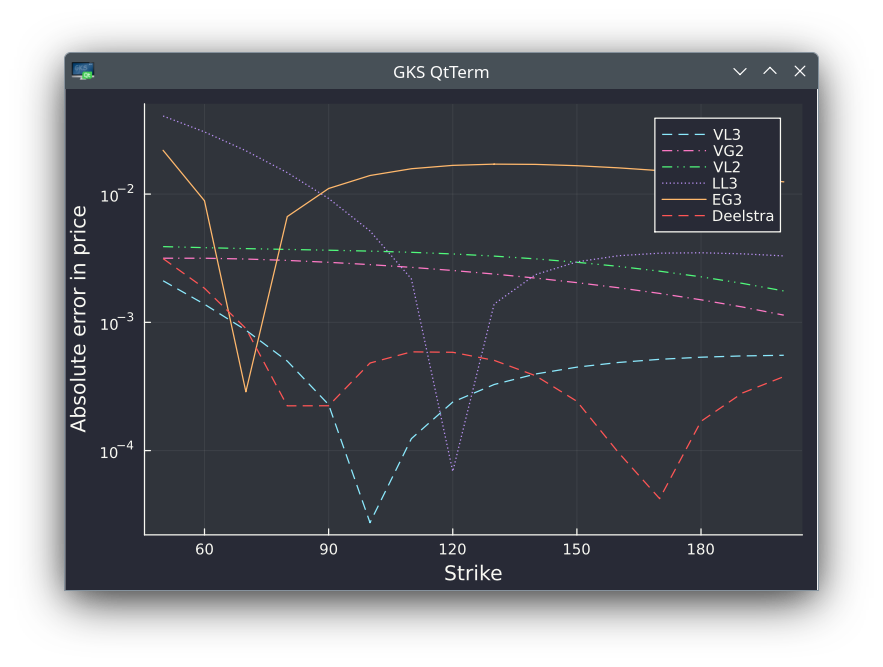

The second and third order basket expansions turn out to be significantly more accurate than the previous, more direct stochastic expansions, even on extreme examples.

Extreme case with large volatility (80% on 1 year) and two unrealistically large dividends of 25 (spot=100). VGn and VLn are stochastic expansions of order n using two different proxies. EG3 and LL3 are the third order expansions of Etore-Gobet and Le Floc'h. Deelstra is the refined Curran moment matching technique.