Decoding Hagan's arbitrage free SABR PDE derivation

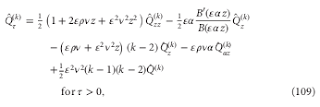

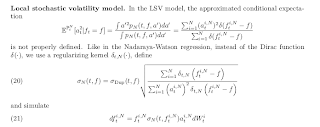

Here are the main steps of Hagan derivation. Let's recall his notation for the SABR model where typically, \\(C(F) = F^\beta\\) First, he defines the moments of stochastic volatility: Then he integrates the Fokker-Planck equation over all A, to obtain On the backward Komolgorov equation, he applies a Lamperti transform like change of variable: And then makes another change of variable so that the PDE has the same initial conditions for all moments: This leads to It turns out that there is a magical symmetry for k=0 and k=2. Note that in the second equation, the second derivative applies to the whole. Because of this, he can express \\(Q^{(2)}\\) in terms of \\(Q^{(0)}\\): And he plugs that back to the integrated Fokker-Planck equation to obtain the arbitrage free SABR PDE: There is a simple more common explanation in the world of local stochastic volatility for what's going on. For example, in the particle method paper from Guyon-Labordère, we have the following expression for the true local volatility.In the first equation, the numerator is simply \(Q^{(2)}\) and the denominator \(Q^{(0)}\). Of course, the integrated Fokker-Planck equation can be rewritten as:

$$ Q^{(0)}_T = \frac{1}{2}\epsilon^2 \left[C^2(F) \frac{Q^{(2)}}{Q^{(0)}} Q^{(0)}\right]_{FF} $$

Karlsmark uses that approach directly in his thesis, using the expansions of Doust for \(Q^{(k)}\). Looking a Doust expansions, the fraction reduces straightforwardly to the same expression as Hagan, and the symmetry in the equations appears a bit less coincidental.