Black with Bachelier

I was experimenting with the recent SABR basket approximation of Hagan. The approximation only works for the normal SABR model, meaning beta=0 in SABR combined with the Bachelier option formula.

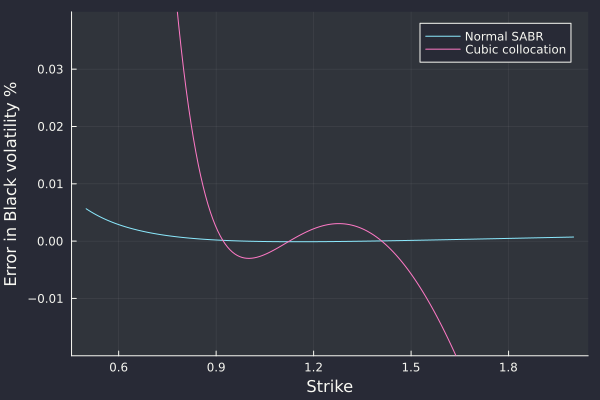

I was wondering how good the approximation would be for two flat smiles (in terms of Black volatilities). I then noticed something that escaped me before: the normal SABR model is able to fit the pure Black model (with constant vols) extremely well. A calibration near the money stays valid very out-of-the-money and the error in Black volatilities is very small.

For very low strikes (25%) the error in vol is below one basis point. And in fact, for a 1 year option of vol 20%, the option value is extremely small: we are in deep extrapolation territory.

It is remarkable that a Bachelier smile formula with 3 free parameters can fit so well the Black vols. Compared to stochastic collocation on a cubic polynomial (also 3 free parameters), the fit is 100x better with the normal SABR.