Arbitrage free SABR with negative rates - alternative to shifted SABR

Antonov et al. present an interesting view on SABR with negative rates: instead of relying on a shifted SABR to allow negative rates up to a somewhat arbitrary shift, they modify slightly the SABR model to allow negative rates directly: $$ dF_t = |F_t|^\beta v_t dW_F $$ with \\( v\_t \\) being the standard lognormal volatility process of SABR.Furthermore they derive a clever semi-analytical approximation for this model, based on low correlation, quite close to the Monte-Carlo prices in their tests. It's however not clear if it is arbitrage-free.

It turns out that it is easy to tweak Hagan SABR PDE approach to this "absolute SABR" model: one just needs to push the boundary \\(F\_{min}\\) far away, and to use the absolute value in C(F).

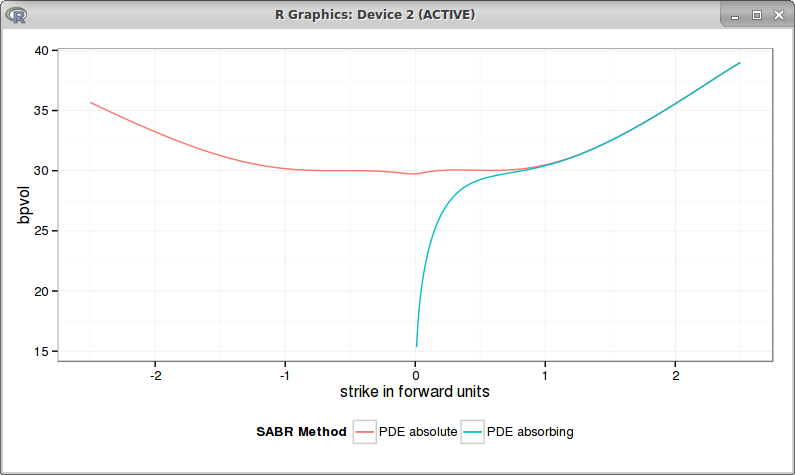

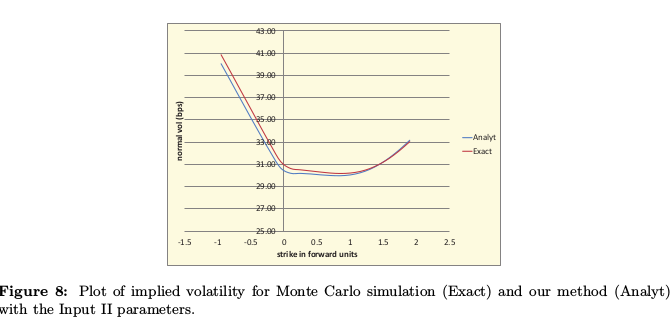

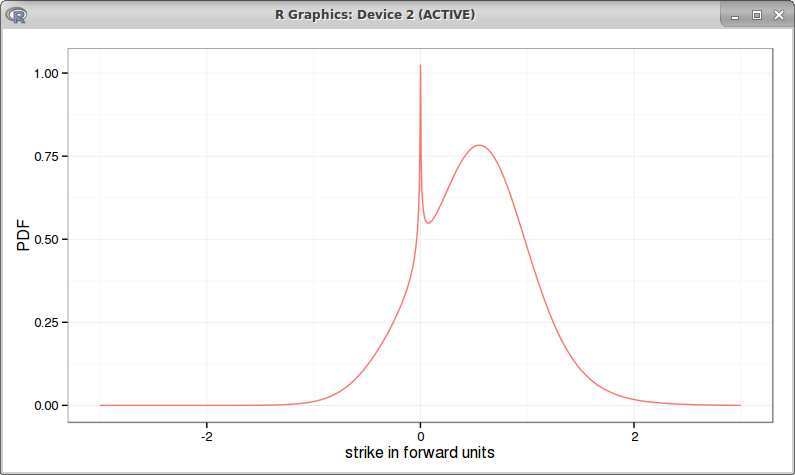

It then reproduces the same behavior as in Antonov et al. paper:

|

| "Absolute SABR" arbitrage free PDE |

|

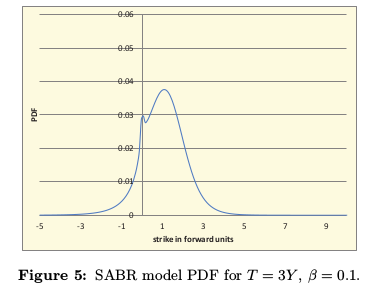

| Antonov et al. graph |

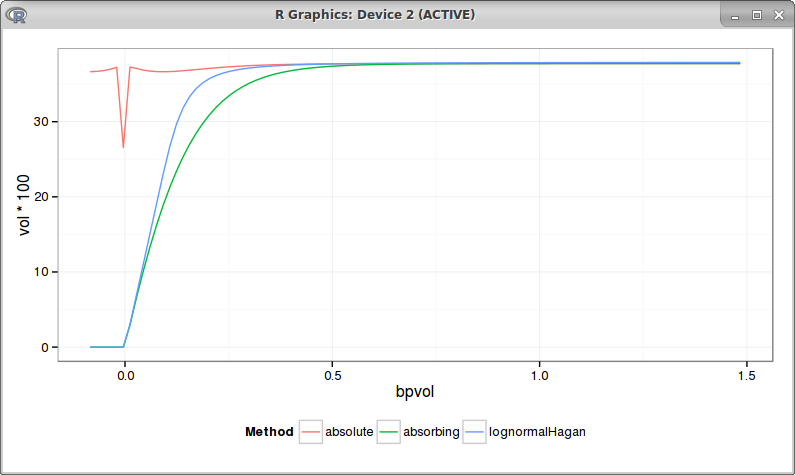

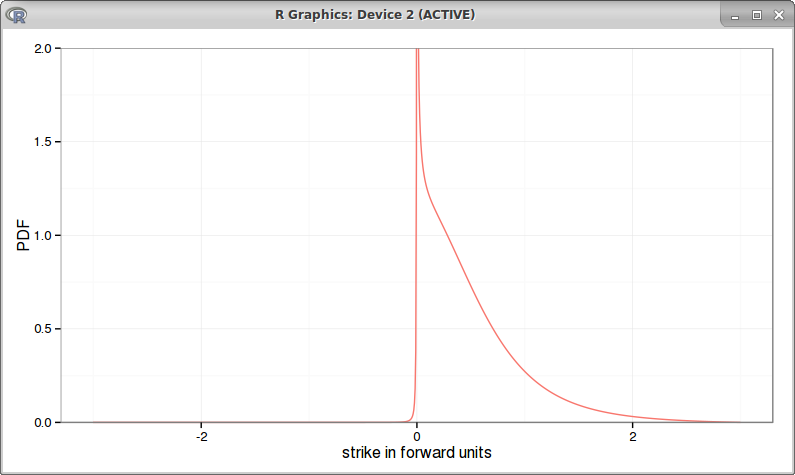

Interestingly, the arbitrage free PDE will also work for high beta (larger than 0.5):

|

| beta = 0.75 |

|

| red = absolute SABR, blue = absorbing SABR with beta=0.75 |

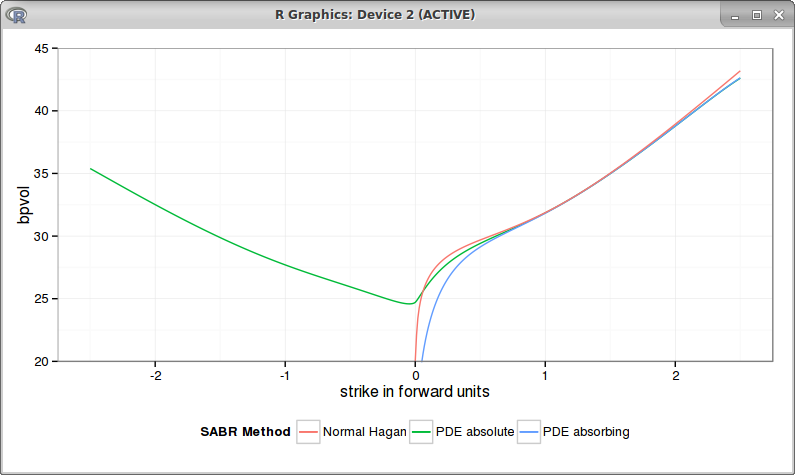

If we go back to Antonov et al. first example, the bpvols look a bit funny (very symmetric) with beta=0.1:

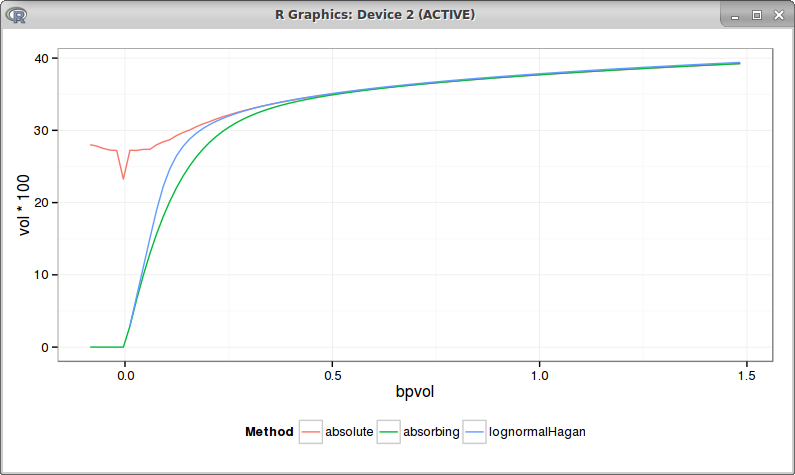

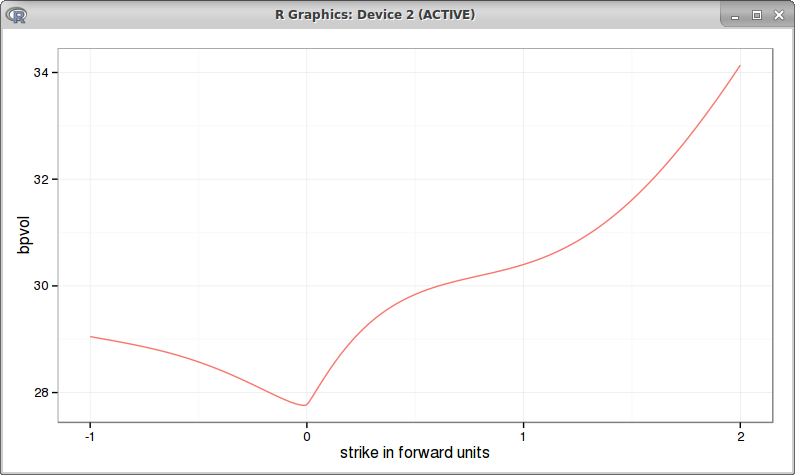

For beta=0.25 we also reproduce Antonov bpvol graph, but with a lower slope for the left wing:

|

| bpvols with beta = 0.25 |

For longer maturities, the results start to be a bit different from Antonov, as Hagan PDE relies on a order 2 approximation only:

|

| absolute SABR PDE with 10y maturity |

Another important aspect is to reproduce Hagan's knee, the atm vols should produce a knee like curve, as different studies show (see for example this recent Hull & White study or this other recent analysis by DeGuillaume). Using the same parameters as Hagan (beta=0, rho=0) leads to a nearly flat bpvol: no knee for the absolute SABR, curiously there is a bump at zero, possibly due to numerical difficulty with the spike in the density:

The problem is still there with beta = 0.1:

Overall, the idea of extending SABR to the full real line with the absolute value looks particularly simple, but it's not clear that it makes real financial sense.