Arbitrage Free Wiggles

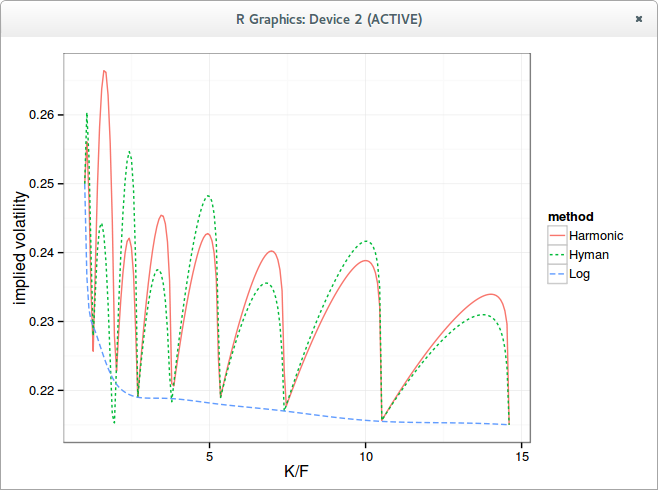

Peter Jaeckel, in a recent paper (pdf), shows that something that sounds like a reasonable arbitrage free interpolation can produce wiggles in the implied volatility slice.The interpolation in question is using some convexity preserving spline on call and put option prices directly and in strike, assuming those input prices are arbitrage free. This is very similar to Kahale interpolation (pdf).

It seemed too crazy for me so I had to try out his example. And using a harmonic spline, it does produce arbitrage free wiggles.

|

| Wiggles in the implied volatility |

|

| Probability Density |

In reality, what one really wants for such data is to just interpolate the log prices with a spline, not the prices. This is the curve named "Log" in the graphs, where a simple cubic spline is used on the log prices, and fed to exp after interpolation.

Now it sounds like a reasonable arbitrage free interpolation would be to interpolate the discrete density log linearly, in a similar spirit as Hagan-West yield curve interpolation (pdf).

In general, if you interpolate very small numbers with a spline, you probably are doing something wrong.